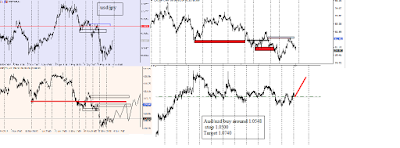

Last week we had good run in Gold and setup was pinpoint around 1320 level and tp was 1348 & that hit in no time. This week we have few setups lined up and one of the best entry point is Aud/nzd which is around 1.0550 with stops around 1.0500 & First Target is 1.740

I’m eyeing big move in Aud/nzd in coming weeks and months . So, I would advise all of you to buy two lots of 0.10 cents with stops around the recent low and psychological level 1.0492

Idea of buying two lots is because we will close one position around recent high which is around 1.0720 level and let the another lot trail around 1.0650 & see if we can reach around 1.0900 level within this week or in the coming weeks or months.

Take a look at the charts of usd/jpy, chf/jpy & Aud/nzd with probabilities or If we can get to the entry point of another pairs within this week.

Usd/cad potential setup awaiting for very good Risk Reward opportunity

If you have been following my blog regularly then you might have known or well aware of Top-down analysis and in case you don’t know how to take a trade from weekly to h4, then it is a great example of the potential setup in usd/cad.

As you see the chart about there is a hug sell-off in the area I mark with Red rectangel followed by retest failure and back to demand . I took that trade with 10 pips stop & got 140 plus pips. Same can be said as We see hesitation in reaching that level took 4 months & when price brokeout of that range , we again witness a huge sell.

Potential of that trade is huge as I’m eyeing new lows below the recent swing which is close to 1.3100 area. Set the stops tight and trail the entry with plus 100 & see the levels get broken very quickly. Take a trade around 1.3530 & set the stops around 1.3580-90 level & enjoy the tremendous potential profits which I see is more than a 70% chance of setup end up in profit.

I’ve also attached USd/jpy chart with the usd/cad chart & potential trade is offering very good reward but it depends on approach completely and if the orders below or above get executed then there are very little chances of sell-off but it still have very good chance of good setup & I would update the chart if I saw any opportunity after FOMC meeting minutes are released on Wednesday.